Issuance of Green Bond (private placement bond)

Posted on October 13, 2022

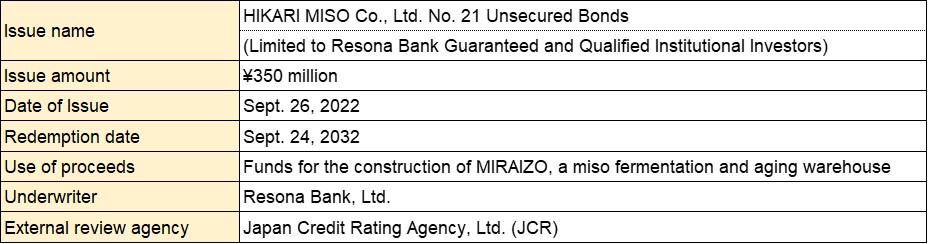

HIKARI MISO Co., Ltd.(”Hikari Miso”)issued the “Green Bond” as a private placement bond on Sept. 26, 2022. The proceeds raised from the Green Bond is allocated to the construction funds for MIRAIZO the new miso cellar – the miso fermentation and aging storehouse – which started operation in July 2022. The facility is designed to have renewable technologies such as a highly efficient room temperature control system, most-modern insulation material used for walls and roofs, and electricity partly supplied by the local CO2-free hydropower.

For the issuance of this Green Bond, the company has formulated the “Hikari Miso Green Finance Framework” to include four core components: 1. Use of Proceeds 2. Process for Project Selection and Evaluation. 3. Management of Proceeds. 4. Reporting. These are stipulated in GBP – Green Bonds Principles 2021 established by ICMA – the International Capital Market Association and the Green Bonds Guidelines 2022 established by the Ministry of the Environment. GBP conformity assessment on Hikari Miso Green Finance Framework is made by JCR – The Japan Credit Rating Agency, Ltd.

Hikari Miso, with its brand message “Nature’s Best, from Our Family to Yours,” is proactively participating in the UN SDGs – Sustainable Development Goals. The use of the proceeds is for energy conservation, resource conservation, and CO2 emission reduction.

The company is, together with all the stakeholders, committed to increase enterprise value by investing into renewable and sustainable improvement that are based on EMS Environment Management System, social responsibility, and corporate governance.

【Overview of Green Bond (private placement bond)】

Media Contact

HIKARI MISO Co., Ltd. Public Relations

info@hikarimiso.co.jp